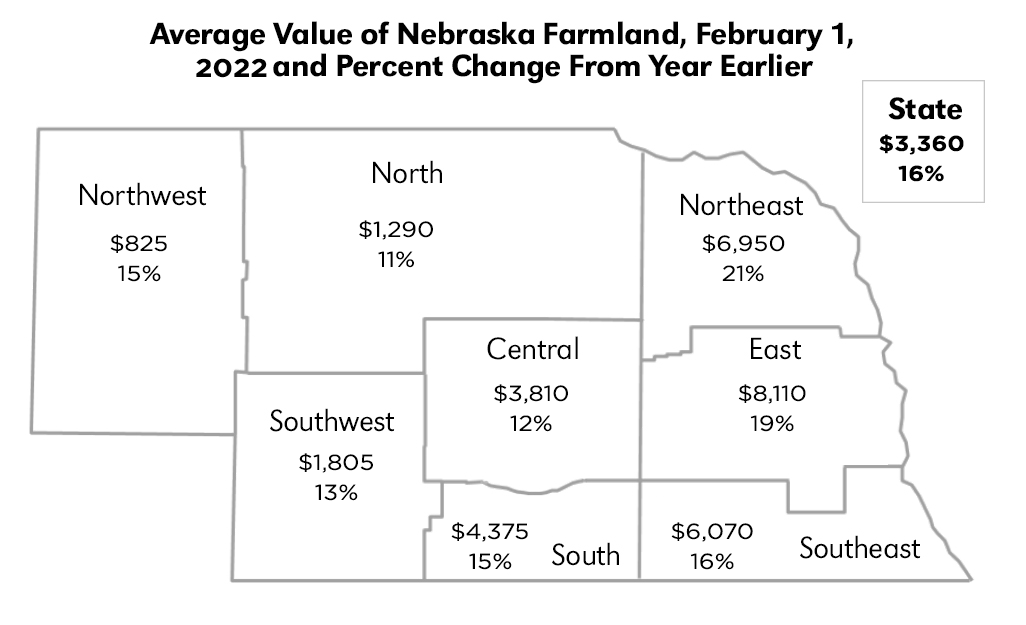

The value of agricultural land in Nebraska increased by an average of 16% over the prior year, to a statewide average of $3,360 per acre, according to the preliminary findings of the University of Nebraska–Lincoln’s 2022 Farm Real Estate Market Survey. This marks the largest increase in the market value of agricultural land in the state since 2014 and is the highest non-inflation-adjusted statewide land value in the history of the survey.

According to the survey, higher commodity prices and interest rates near historic lows have contributed to the recent robust real estate sales market. Survey participants also reported that those purchasing land looked to the asset as a hedge against inflation and economic uncertainty.

“Many operations improved their financial positions in the last year, despite rising machinery costs and input expenses,” said Jim Jansen, an agricultural economist with Nebraska Extension who co-authored the survey and report with Jeffrey Stokes, a professor in the Department of Agricultural Economics.

Jansen noted that the outlook for 2022 appears favorable, as commodity prices continue to rise, but cautioned against rising input expenses and concerns about drought across Nebraska.

Statewide, the preliminary report found that estimated values of center pivot-irrigated cropland rose by about 17%. Dryland cropland values rose between 15% and 19%. Grazing land and hayland market values range from about 10% to 13% higher than the prior year.

Survey results also revealed that cash rental rates for dryland and irrigated cropland trended higher, averaging about 10% to 15% higher than the prior year. Survey participants indicated crop prices as the major factor contributing to the increase in rental rates.

Grazing land and cow-calf pair rental rates trended steady to higher, with average statewide rates increasing about 6% to 8% over the prior year.

The Nebraska Farm Real Estate Market Survey is an annual survey of land professionals, including appraisers, farm and ranch managers and agricultural bankers. It is conducted by the Center for Agricultural Profitability, based in the Department of Agricultural Economics. Results from the survey are divided by land class and agricultural statistic district. Land values and rental rates presented in the report are averages of survey participants’ responses by district. Actual land values and rental rates may vary depending on the quality of the parcel and local market for an area. Preliminary land values and rental rates are subject to change as additional surveys are returned.

The preliminary report was released in the Department of Agricultural Economics’ weekly Cornhusker Economics newsletter on March 16. Its findings will be discussed during a pair of virtual landlord/tenant cash rent workshops that will be held March 24 and 25. To register for the workshops and read the report, click here. Final results from the survey are expected to be published in June.