· 5 min read

Honors students support free tax preparation

University of Nebraska–Lincoln students are using their accounting, leadership and communication skills to meet the needs of community members.

Through a partnership between the University Honors Program and Lincoln VITA, honors students spend Saturdays helping community members prepare federal and state taxes for free. The initiative creates a mutually beneficial relationship between community members and university students. And, participating students earn an advanced tax law certification and invaluable service experience.

“It’s a great experiential learning opportunity for our students,” said Linda Moody, VITA coordinator, who has worked with the program since its inception in 2003. “They’re gaining life skills learning about their community.”

Lincoln VITA is a local branch of the IRS Voluntary Income Tax Assistance program. The program offers free tax preparation for qualified individuals in three ways: in-person, online and self-preparation help. Individuals seeking assistance from VITA can sign up for an appointment at one of the Lincoln VITA locations.

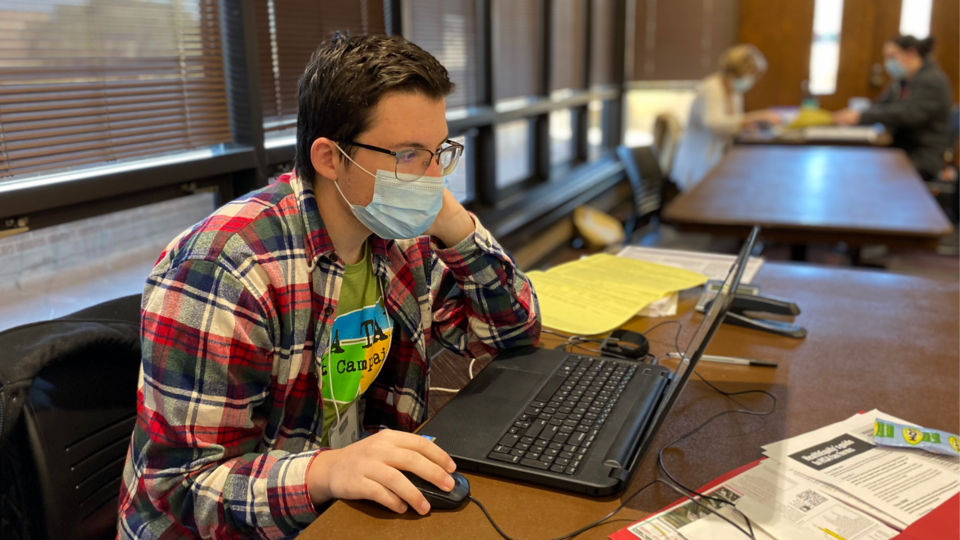

Carson Swartzbaugh, a sophomore accounting major and honors student from Omaha, was initially drawn to the VITA honors course because it was related to his major, but it was the opportunity to help people in the community by easing the stress of taxes that solidified his choice. Swartzbaugh is one of 10 honors students who are volunteering with VITA this year.

“Interacting with the clients has been my favorite part of the VITA experience,” Swartzbaugh said. “Many of the people that we have worked with express their gratitude toward us as many of them don’t have the means to do their taxes on their own. It’s great to see and hear from the people that we are helping just how much it means to them.”

About 10 university students typically volunteer for Lincoln VITA annually, but this is the first year of the organized partnership with the Honors Program. VITA is one of the class options that fulfills a requirement for sophomore honors students to have a short-term experiential learning opportunity.

“We created these short-term experiential learning opportunities as part of our efforts to develop a curriculum that’s going to support retention and increase student engagement with the Honors Program over time,” said Jacob Schlange, assistant director of experiential learning and global initiatives in the University Honors Program.

The class options, including the VITA opportunity, support the Honors Program’s learning outcomes, which include problem-solving, communicating with diverse audiences, taking initiative and independence. The program also focuses on developing students’ transferable skills so that they’re prepared not only for their first job, but their third or fourth.

“We really emphasize the idea that students might not be doing tax preparation in their future job, but there are skills that they will gain from this experience that can be translated into their future job,” Schlange said.

The university’s VITA program began 17 years ago, and this marks the 40th year of free tax preparation provided by a unit on campus.

“In 1982, the law school and a few community volunteers started doing free tax prep at Gateway Mall,” Moody said. “And from back then, it’s grown into what it is today.”

Today, the VITA program serves 2,400 students, families, community members, low-income individuals and non-filers.

VITA takes the guesswork out of taxes for people with more intricate returns such as international students, retired people and those with children, who would otherwise have to pay expensive accounting fees.

“What’s so significant is that a lot of people don’t know about these credits, earned income credits, educational credits and child care credits, which are all things that families potentially are eligible for,” Moody said. “If they go to a paid tax preparer, they might not tell them about some of the credits, and on top of that they’re paying a huge fee to have their taxes prepared.”

There are more than 17,000 children living in non-filing households, leaving a large amount of money in child tax credits potentially unclaimed from Nebraska families, and money that’s kept out of local economies. This is just one reason Lincoln VITA’s services are so crucial.

“I’m a huge advocate of service learning, and that is connecting coursework to real-world needs,” Moody said. “It’s important for our students to participate in VITA not only for that career experience, but also to understand and break down those barriers and stereotypes that people might have toward low-income and diverse groups.”

Swartzbaugh’s experience has opened his eyes to the diverse people in his community and helped him apply his coursework to something that has an impact outside of the university.

“It’s great to get to talk to people from all different walks of life and from places all over the world that all ended up here in Lincoln,” Swartzbaugh said. “It has made me extremely grateful for the opportunities that I have been able to have, and it has greatly changed the way I see the world just from being able to interact with such a diverse group of people that I probably never would’ve met without VITA.”

The Lincoln community also benefits from interacting with NU students.

“They love it when they get to have a UNL student prepare their tax returns,” Moody said. “It means a lot to some of our clients to see young college-age students giving up a Saturday afternoon to serve in their community, let alone do taxes.”

Community volunteers and honors students are expanding the program’s outreach into two new communities, Adams and Dawson counties.

“As a land-grant university, it’s all about how we serve our communities and understanding their needs,” Moody said.