· 4 min read

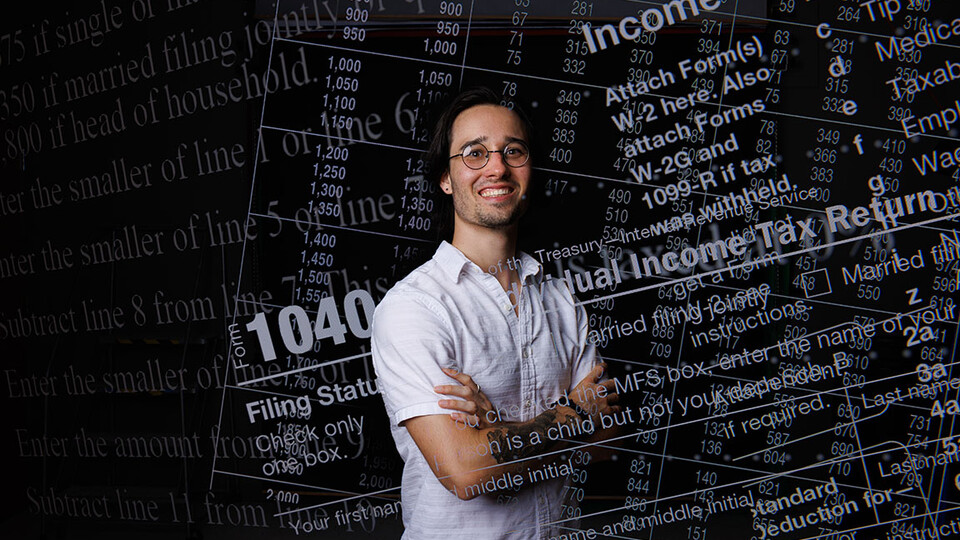

Husker’s summer internship aims to bring tax education to Nebraska schools

An old adage claims there are only two certainties in life: death and taxes.

Matt Price, senior political science major with minors in Spanish and history, helped develop an introduction to one of those certainties — taxes — that could help Nebraska high school students as well as their communities.As a summer intern with the Volunteer Income Tax Assistance program, Price collaborated with Nebraska teachers to develop a way to train high school students to provide tax services.

“I was able to create something that I’m proud of that I hope can be used in teaching students tax law and help students gain that financial literacy that I wish I had had going to high school,” Price said.

He learned of the opportunity through the University Honors Program. Price was tasked with developing a curriculum to teach high school students about tax preparation so they can hold a VITA site during tax season. They would learn about each of the various tax forms and documents someone might bring in, available tax credits, and dependents. The students then have to pass a certification test from the IRS in order to volunteer at the site.

Other students could work a welcome table or review documents. Price said it was important to include as many students as possible and find roles that fit their strengths, even if they’re not preparing returns.

“It’s important for students of all ages to have knowledge of taxes,” Price said. “Part of that is catering to different skill sets so they have a way into taxes, making sure everyone can jump into taxes and understand something about it.”

That concept of making tax information available to everyone is a core principle of VITA. Rural areas might not have some of the same resources, and a program like the one Price worked on can help fill in some of those gaps.

“What these communities do have are high schools, institutions that can facilitate a program like VITA,” he said. “If we get high school students involved, the service to the community is so great, you can’t really put numbers to that.”

One of Price’s favorite parts of the project was helping to lead focus groups of high school teachers about what they were looking for from the program. Their responses indicated they wanted something they could make available to all students during class time.

“Many teachers wear many different hats,” Price said. “So one of the things teachers came to that conversation with was, ‘don’t give us something else that will take up more time that we don’t have.’ That shifted our focus to, if we can get this in the classroom, then we’ll be able to pull a lot more teachers in. We’re not asking them to put in more hours after school.”

The next step is to put pilot programs in Nebraska high schools, actually getting the curriculum in action. The first will be in Gibbon and Cozad. Teachers from those districts participated in the focus groups.

The experience gave Price a fuller appreciation for educators. As a political science major who had never before done any work developing a curriculum, he said the project helped him understand more deeply the challenges of keeping students engaged.

“Trying to find a way to make sure students will not only enjoy the stuff I’m creating but will also learn something from it, that it’s enriching as well as educational, was truly the biggest hurdle…that I hopefully conquered so this will be successful,” Price said.